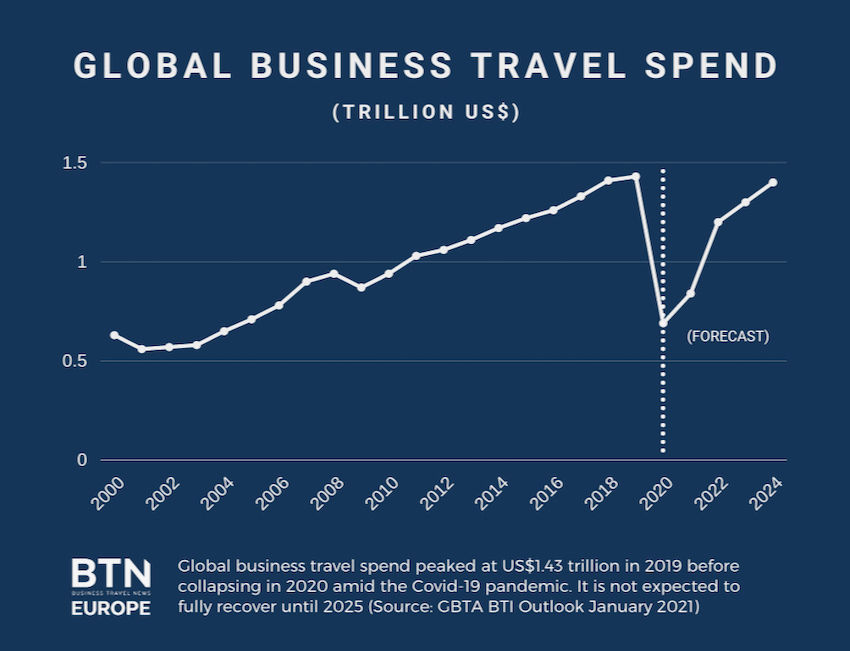

GBTA's annual Business Travel Index has pegged 2025 as the year global business travel volume will surpass its $1.4 trillion peak from 2019, after being felled by the Covid-19 pandemic in 2020.

The study, conducted in partnership with Rockport Analytics, estimates that global business travel volumes fell 51.5 per cent versus 2019. That's 10 times worse than the business travel slump that followed 9/11 or the Great Recession in 2008.

GBTA research director Chris Ely said 2021 will continue to be "a year of survival" for the business travel industry, but recovery toward the back half of the year should deliver a significant boost.

The study projected 21 per cent growth in global business travel volumes in 2021, followed by roughly 38 per cent growth in 2022, which would elevate global business travel spend back to $1.2 trillion, but still shy of full recovery.

"That's huge growth again," said Ely about the 2022 projection. "Business travel is a key component of the economy, so as businesses are looking to dig themselves out and pursue new clients, that's when business travel kicks in."

The study predicted businesses would prioritise sales travel during the early recovery period in 2021, followed by service and repair travel to existing customers.

Internal meetings, according to the research, would be prioritised over external conferences, events and trade shows, while travel for employee training and supplier meetings would be less important, especially given virtual alternatives.

Ely underscored that "busines travel is a key component of the economy," but it won't be the first mover in recovery. "Governments are pumping money into their economies," he said.

That type of stimulus combined with effective vaccine distribution and inoculation programmes must happen first, according to the study, and the markets that master those elements will recover business travel volumes faster. The report pointed to China and other Asia-Pacific markets as models.

Despite the challenges, GBTA interim executive director Dave Hilfman said he was optimistic about a full industry recovery. "We've seen domestic travel in China recover almost completely. We can have similar results as we make our way through this year," he said.

International travel, Hilfman acknowledged, would take longer. "We need vaccines and standard covid testing to help open borders. I like to be action oriented, but right now we have to have patience as vaccines roll out and we start to get control of the virus."

Researchers had a tough hill to climb to assess the damage of 2020 and

project volumes for 2021 and beyond. The association delayed the study's

release given the volatility in the travel environment, and the report

utilised data from many additional sources to validate trends and

projections, said GBTA's Ely.

"The 'rules' of travel – if you

want to call them that – are changing on a daily basis. If you look at X

as it relates to Covid, a week later it's different," Ely said.

"Governments are scrambling [to understand economic recovery] and plot a

course, and because it's changing so fast, you have to ask how good is

the info you are getting. The good news is that we had more data sources

this year than ever before. We got additional inputs on corporate

travel and bookings on a global scale."

The 2019 BTI, which was

released in July prior to the GBTA convention in Chicago, projected

slowing growth for the segment, but estimated total global travel spend

to hit $1.51 trillion in 2020. The Covid-19 pandemic reversed fortunes

for the entire travel industry. The current report pegged 2020 global

business travel spending at $694 billion.

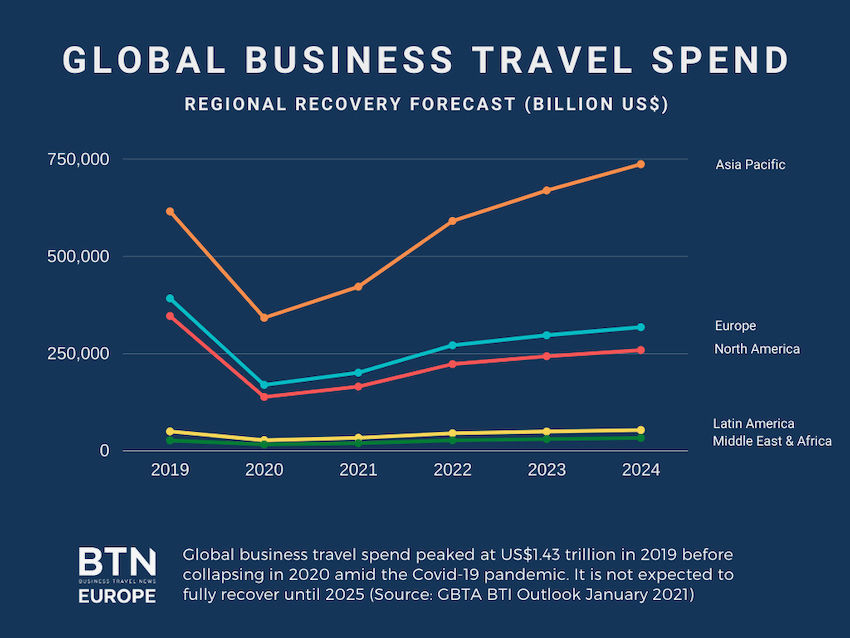

Regional analysis

The GBTA report analysed global markets by eight factors to guide projections through 2024: the size of the economy; land mass, population and business dispersion; industry mix; technology and productivity of business travel; export dominance; physical location; infrastructure; and environmental, tax, security and health regulatory policy. The study projected the following:

Europe

Western Europe: Researchers projected busines travel for Western Europe to fall 58 per cent from 2019 level of $335 billion. The region was hard hit by the pandemic and continues to struggle with new virus variants as well as disputes regarding vaccine distribution. Another factor weighing on business travel spending in Western Europe is "the dependence of many companies and countries on intra-regional travel and economic activity. The dizzying array of country restrictions and policies from the outset of the pandemic made it very difficult for travellers to follow," wrote the researchers. Though not cited in the report, Brexit has introduced more complexities for business travel to and from the United Kingdom, including documentation requirements that may stymie business travel that would otherwise have recovered quickly.

Emerging Europe: Research authors separated Europe into two segments. 'Emerging Europe', which includes countries like Romania, Russia, Poland, Turkey and Ukraine, saw business travel decline by 48 per cent in 2020 to $29.7 billion, and is expected to recover back to its 2019 peak of $57.2 billion by 2024.

North America

According to the GBTA report, business

travel spending in North America hit nearly $347 billion in 2019, with

the United States accounting for more than 90 per cent of that spend.

The US, however, was hard hit by the pandemic and cases and

hospitalisations continued to rise going into 2021. Tense international

trade relations, especially with China, had already hindered business

travel growth in that market. Researchers predicted North American

business travel would experience the steepest declines in the world in

2020, and particularly the US, where the report estimated a 61 per cent

drop for 2020. Canada, researchers said, would see business travel fall

51 per cent and Mexico a comparatively modest 44 per cent decline. The

report called out the roll of government and the administration change

in the US as a catalyst for business travel recovery there, citing the

likelihood of the Biden administration "to lead much more liberal trade

and immigration policies" and hopes for a cohesive public safety

strategy that would include a "coordinated vaccine campaign across the

US and North America."

Asia-Pacific

Comparatively, Asia-Pacific saw less

business travel decline in 2020 than most other regions, dropping 44 per

cent versus 60 per cent declines in North America and 58 per cent

declines in Western Europe. Researchers also noted the region will see

quicker recovery. China's early infections, followed by strong

lockdowns, precipitated a comparatively speedy recovery from Covid

infection rates in the second quarter. The study estimated 2020 business

travel in China to decline by 38 per cent, buoyed by the country's

historically strong domestic demand, which was largely recovered by the

fourth quarter. "The hardest hit markets in the region will include

those that are dependent on international business travel like Singapore

which is set to decline by 82 per cent in 2020," researchers wrote.

"Business travel in Hong Kong, likewise, will plummet by 84 per cent in

2020."

Latin America

Business travel volumes in Latin America were already struggling going into the pandemic, declining to $50 billion in 2019. Political crisis in Venezuela and ongoing recessions in Argentina and Ecuador, on top of the early emergence of Covid-19 in Brazil in February 2020, weakened business travel performance in the region. However, strong domestic business travel as well as fewer travel restrictions in the region, overall, saved some business trips. Volume fell 45 per cent compared to 51.5 per cent globally.

Middle East & Africa

The Middle East & Africa witnessed strong business travel growth going into 2020. The region experienced 7 per cent growth in 2018 and an additional 2.6 per cent growth in 2019 put total business travel spend for the region at $27 billion. According to the GBTA report, 2020 business travel declines in the region were less severe than other markets, driven largely by lower Covid-19 case rates compared to North America and Europe. Researchers also cited less discretionary business travel – i.e. the business travel that was taking place was directly tied to business operations. Given those factors, researchers expected the MEA region to recover at an average annual 4.3 per cent between 2019 to 2024, outperforming all other regions. Recent reports of highly contagious Covid-19 variants in South Africa, a major business travel market for the region, could hinder that recovery pace.